The second half. November 30 2020.

T4 Slip Statement Of Remuneration Paid Personal Income Tax Canada Ca In 2021 Tax Forms Income Tax Employee Tax Forms

Heres How To Claim Your Money.

Child tax credit 2021 dates canada. Families that already receive the CCB will not need to take any action to receive the payments. Recipients who are single can get up to 451 married couples can get up to 592 plus up to 155 per child under age 19. This logic also explains why your 2021 child tax credit is split into two parts.

New monthly payments worth up to 300 from the enhanced child tax credit are set to begin on July 15 and will go to about 39 million households. These changes apply to tax year 2021 only. July 15 is just first of the several dates to circle on your calendar.

You will claim the other half when you file your 2021 income tax return. The final two payments will be issued on July 30 and October 29 2021. People who qualify for the Canadian Child Benefit CCB will receive up to 1200 in 2021 for each child under the age of six they have the government announced today.

2021 payment dates deadlines to unenroll IRS portals eligibility. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. The first half in 2021 will come as advance monthly installments you can start using right away.

Payments go out quarterly every year so you can expect a similar schedule for 2022 and so on. Here are other child tax credit. The Canadian government announced the countrys latest federal economic package on Monday and it includes good news for those with a young family.

Canada child benefit CCB Includes related provincial and territorial programs. The first advance monthly child tax credit payment comes July 15 with recurring checks through the end of 2021. The Minister of National Revenue Diane Lebouthillier and the Minister of Families Children and Social Development Ahmed Hussen announced the supplement payments will be issued to Canadian families who receive the CCB for children under the age of six beginning May 28 2021.

Canada Child Benefit Dates 2021. For the July 2020 to June 2021 payment period that is based on your 2019 net income you will receive GSTHST credits when your family income is less than. Canada Revenue Agency CRA will send out Canada Child Benefit payments for 2021 on the following dates.

CCB young child supplement The CCB young child supplement is paid to families who are entitled to receive a Canada child benefit CCB payment in January April July or October 2021 for each child under the age of six. Heres a list of the GST payment dates for 2021. The amount you receive depends on your family net income in 2019 and 2020.

This years child tax credit amounts to 2000 per child. The first payments will be issued on May 28 2021 which will include both the January and April payments for those entitled to them. The first child tax credit payment comes July 15 with checks each month through the end of 2021.

In a press release the Canada Revenue Agency CRA said the CCBYCS is expected to benefit about 16 million Canadian families and about 21 million children under the age of six. Canada child benefit CCB Includes related provincial and territorial programs. The final two payments will be distributed on July 30 and October 29 2021.

Married couples filing jointly who make under 400000 per year and single individuals head of household or married couples filing separately who earn less than 200000 per year will be able to take 2000 per child as their Child Tax Credit. CRA has this useful calculator to estimate your GSTHST credit. GST payment dates for 2021.

From Your Site Articles Ontarios COVID-19 Child Benefit. December 13 2021 Havent received your payment. The IRS will pay half the total credit amount in advance monthly payments beginning July 15.

Child tax credit FAQ.

Canada Child Benefit Extra Payments Will Start In May 2021 Narcity

Psa Didn T Get A Stimulus Payment You Might Need To Do This In 2021 Child Tax Credit Tax Debt Irs

Abdulrahim24 I Will Provide Tax Consultancy File Tax Return And Create Ntn For You For 10 On Fiverr Com In 2021 Tax Return Filing Taxes Tax Consulting

Rrsp Canada A Guide For Dummies Reconcile Your Wallet Retirement Savings Plan Saving For Retirement Ways To Save Money

Canada Child Benefit Vs The Universal Child Care Benefit 2021 Turbotax Canada Tips

Maternity Paternity Leave In Canada Video In 2021 Paternity Leave Maternity Leave Maternity

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Canada Tax Deductions Tax Credits To Take Advantage Of In 2021 Tax Deductions Tax Credits Tax

What Motor Vehicle Expenses Can You Claim On Income Tax In Canada Income Tax Tax Motor Car

A Critique Of Canada S Tech Startup Ecosystem Whose Growth Is Being Held Back By The Mindset Of Angel Investors The Governmen In 2021 Tech Startups Start Up Ecosystems

Child Tax Credit Parents With 2021 Babies Can Get Up To 3 600 Too Cnet

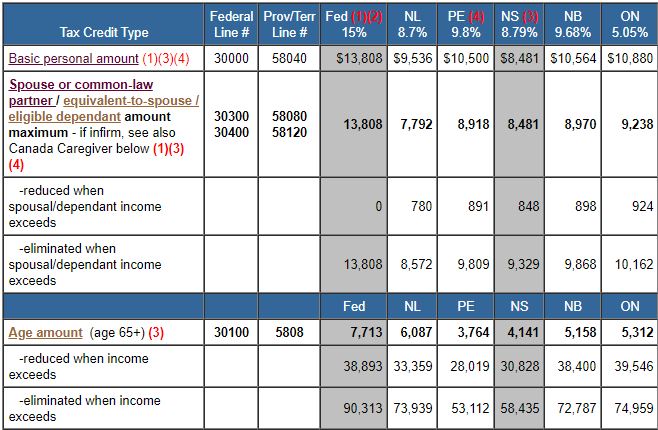

Taxtips Ca 2021 Non Refundable Personal Tax Credits Base Amounts

Canada Child Benefit Ccb Dates Amounts And Application

Child Tax Credit 2021 When Payments Start How To Opt Out

Canadian Disability Tax Credit 2021 Turbotax Canada Tips Tax Credits Turbotax Tax Prep

What Can I Claim On My Taxes In Canada The Young Professional Tax Refund Tax Deductions Tax Return

What Is A Foreign Tax Credit Tax Credits Federal Income Tax Tax

Child Tax Credit Faq 2021 Payment Dates Deadlines To Unenroll Irs Portals Eligibility Cnet

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Income Tax Net Income Income